The

Lazy Man’s

Financial Plan

Balancing today’s wants and tomorrow’s needs without too much work

Money is tough—it's easy to feel like there's never enough. And it doesn't matter if you've got a lot or a little. You'll never feel secure in your spending and saving if you don't have a financial plan. But life is short. While money may not buy you happiness, it can certainly help pay for some good times along the way. No one wants to be broke at the end of their career, but we shouldn't also deprive ourselves in the prime of our lives all in the name of a splashy retirement. Instead, the idea is to find a happy middle, where your short-term wants don't always get the upper hand over both your long-term savings and an emergency fund.

After all, a survey from LendingTree found that six out of ten millennials don't have enough put away to handle a $1,000 emergency expense. Which means they'd have to borrow the money, putting it on a credit card, or sell something to make the necessary payment. And then there's our debt, which also makes saving a challenge. The average American owes about $22,713 (excluding home mortgages) according to Northwestern Mutual's recent Planning & Progress Study.

The uncomfortable reality when it comes to money is that most people don't have much control over what comes in, but they do have control over what goes out. When you control that, you're able to sock more away for both goals (like vacations and other big ticket purchases) and saving for the future. If you're not the type that gets excited by saving money, dealing with finances is a real drag. Thankfully, it's now easier than ever to lean on technology to help sort out the minutia of your monetary life. Herewith, the lazy man's guide to getting ahead financially.

Automate

Automate

Your Savings

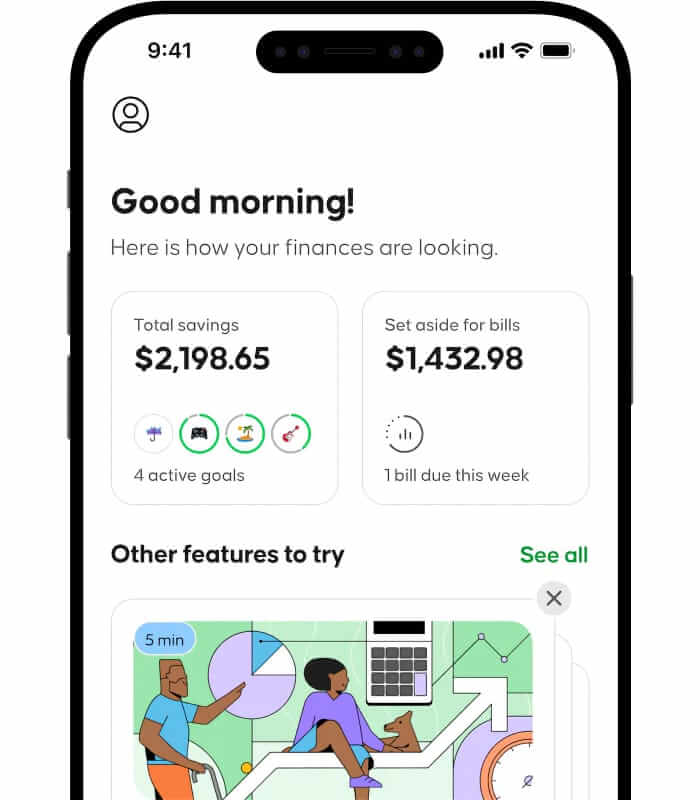

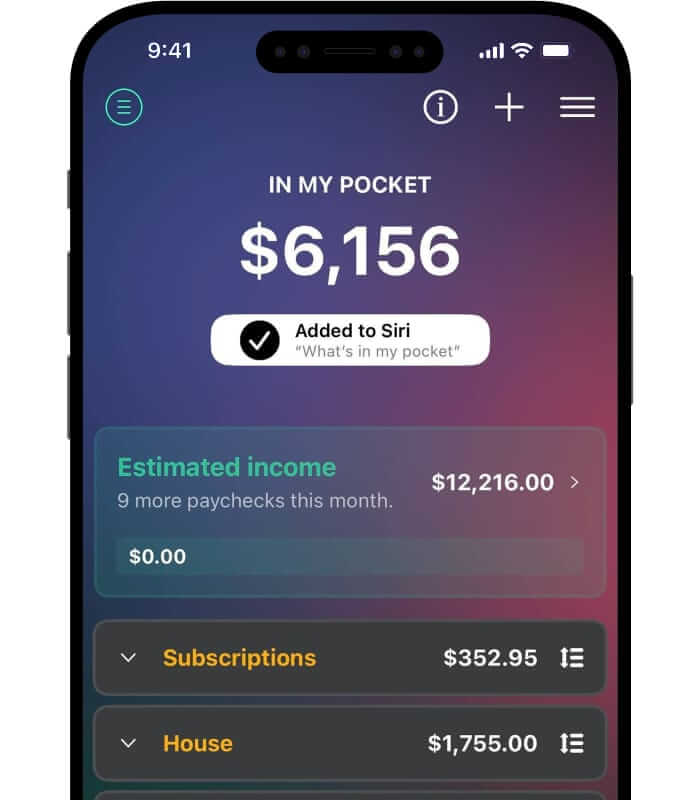

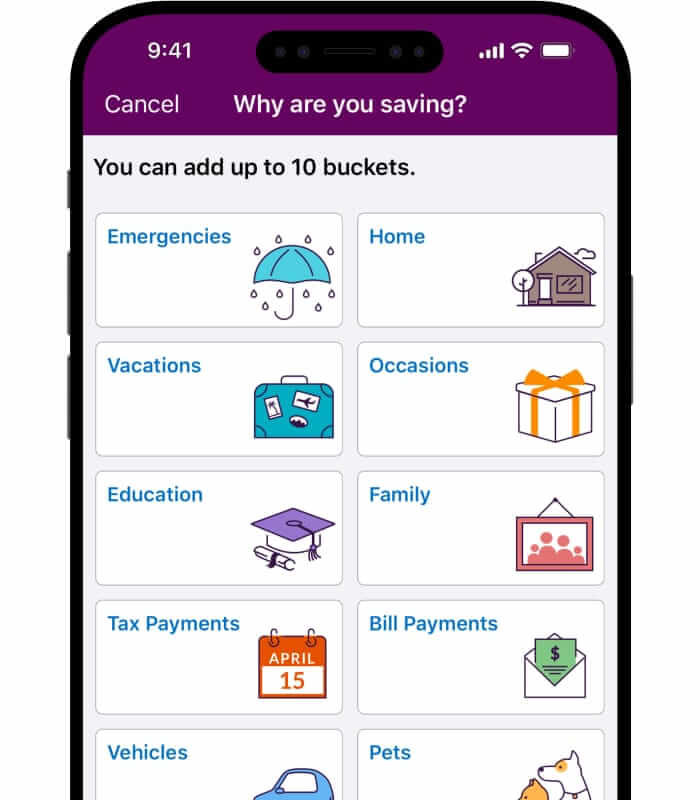

Save money without even having to think about it. This is, by far, the easiest way to ensure you're adequately putting some money away because it removes any chance of skipping out on your responsibility. Automated deposits are simple and effective because they take money directly from your paycheck and put it into a savings account. You can also use a service or an app like Oportun or Qaptial to make saving a painless endeavor. These handy tools analyze your spending and automatically deduct small amounts from your account to help you save little by little.

Track

Your Spending

Track

Your Spending

Tracking brings awareness to any situation. Whether you're making $25,000 or $250,000 a year, financial planners will tell you that we need to understand where our money is going. You could use your phone's note app to log what you spend throughout the day. Doing this, even for a week, will bring a heightened consciousness level to your spending. Or simply dedicate a debit card to your discretionary expenses, or even a credit card (if you commit to paying it off each month) to help you get a clear picture of how much you're spending day-to-day on the non-essentials. Apps like PocketGuard will also tie into your bank and help categorize spending to aid in building a workable budget.

Take Your

Savings Online

Take Your

Savings Online

Don't simply stash all of your money in an account at your local bank with its rather paltry interest rate. Shop around for an online savings account or other high-yield savings account, that have annual percentage yields, or APYs, that are about 10 times higher than the national average. At the time of publication, options like Ally (4.04%), SoFi (4.50%), and UFB Direct (4.83%) are offering interest that can make your savings grow much faster than your standard brick-and-mortar bank account.

Let Bots

Make the Call

Let Bots

Make the Call

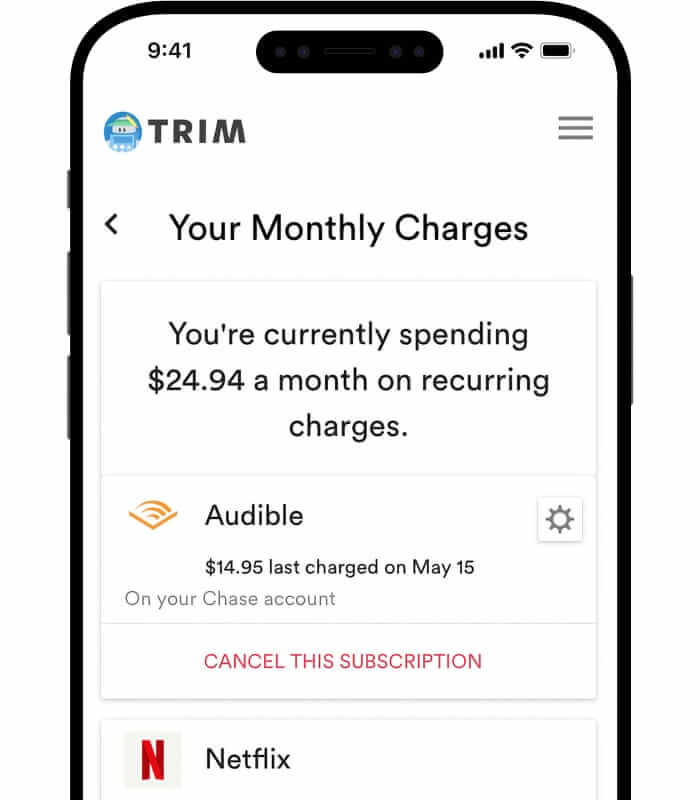

Part of spending wisely is not overpaying for things. A wealthy guy has money managers or lawyers to negotiate on his behalf. For the rest of us, there's Trim. It's essentially a financial assistant in the form of a handy website and text-messaging bot that uses artificial intelligence to analyze your spending and uncover ways to save you money. After you sync your accounts, Trim scans them for recurring payments and alerts you to possible “ghost” subscriptions you may or may not know you're paying for each month. The service can even cancel unwanted subscription, negotiate refunds or better deals on things like your cable or internet bill, along with finding more affordable car insurance in your area.

Disposable vs. Discretionary Income

“Disposable income” is total personal income minus any taxes. “Discretionary income” is disposable income (after-tax income), minus all payments for living expenses (food, medicine, rent or mortgage, utilities, insurance, transportation, etc.). This is what’s truly left to spend or save.