Slim leather card case,

$52 by Billykirk

Slim leather

card case,

$52 by Billykirk

These days, we make the majority of our purchases not with cash but with credit cards. All kinds of credit cards—from business cards to store credit cards to travel reward cards to cash back cards. With so many options available, it's easy to accumulate more plastic than you need. After all, who among us hasn't fallen prey to the lure of store credit cards and that initial discount? A recent Gallup poll found that nearly 80% of Americans carry at least one, but the average American has more than three credit cards.

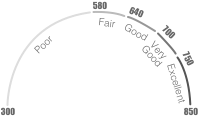

So what do you do if you don't want all that credit and accompanying debt? Should you close excess cards? Leave them open and empty? And how might those actions impact your credit score—which can affect your ability to get a loan for a car, rent an apartment, buy a home or even buy a new phone. Here's what you need to know.

What's the right amount of credit cards?

There's no hard and fast rule about how many cards one should have. Priya Malani, the founder of Stash Wealth, a modern financial planning service, says that she typically advises clients to have no more than three cards open. This makes it easy to keep track of spending and spot fraud but allows you to spread out your debt and boost your credit utilization ratio (CUR), which accounts for 30% of your overall credit score.

Your CUR is calculated by looking at the amount of credit you're using, and dividing it by the amount of credit you have available. Say you have three credit cards:

Credit Card 1

Credit Limit

⋮

with a

⋮

Balance

Credit Card 2

Credit Limit

⋮

with a

⋮

Balance

Credit Card 3

Credit Limit

⋮

with a

⋮

Balance

Total Debt ($4,000) / Total Credit ($15,000) = 27% Utilization

Consider outstanding debt when closing a card

If you pay off Credit Card #3 and decide to close the card, you'd still have $3,500 worth of debt, only now your available credit will drop to just $7,000. Meaning your credit utilization just jumped to 50%. The decrease in your available credit actually drags down your credit score. Stash Wealth advises clients to maintain a healthy CUR—anything under 30% is good. Under 20% is great. So in the above scenario, you'd be better off keeping the account open and paid off to maintain the available credit (or utilize the card for beneficial balance transfers with a lower or temporary no interest rate).

Your oldest card isn't always the best

It's true that the shorter your credit history is, the bigger the impact closing your longest line of credit may have on your credit score. Credit history is important (it's the third-largest component of your credit score), so if your first credit card was a good one, then by all means keep it open. But if it's a bad card, meaning it's got a high annual fee or if you're carrying a balance that's saddled with a high APR, you'd be wise to transfer the balance to a new, lower APR card and close the old account. There may be a small, temporary hit on your credit score but it will even out over time as you make progress paying on the new card.

Make Up the Difference

When you close a card, you lose some of the overall credit available to you. But you can make up some or all of the difference by requesting a credit line increase from your open cards.

Close a card the right way

If you'd like to be done with a card once and for all, but are nervous about the effect it will have on your credit score, there are tools you can use to asses the potential damage. Creditwise, a free tool and app from CapitalOne, lets you access your credit report and simulate how different actions will impact your credit score while allowing you to monitor activity going forward.

Then, when you're ready to close a card, make sure the account's balance is paid in full. Stop any automatic payments and transfer any reoccurring bills (gym membership, Netflix, etc.) to another card. Then you're ready to call your credit card company and request that the account be "permanently closed." This ensures that no new charges can be added to the account in the future. To ensure you have documentation of this, you can request that the company send you a confirmation that the account was closed with a zero balance, as well as that the company is reporting the account as "closed by consumer" to the credit bureaus.

Make Up the Difference

When you close a card, you lose some of the overall credit available to you. But you can make up some or all of the difference by requesting a credit line increase from your open cards.

Volume 10 // 2018

31 Days is back ... And 2018 marks its tenth iteration. When we started this a decade ago, we never imagined that these daily guides to being better men would take off and become one of Valet.'s most popular series of all time. So thank you for your continued support and belief in our mission. This year, we're focusing on productivity—ways in which you can streamline and improve your days to make your job less stressful, your work more efficient and your life run just a bit more smoothly. It's time to raise your game.

-

1Get a Jump Start

on Your Day -

2Slow Day?

Energize! -

3The Power of

Saying "No" -

4Faster Haircut =

Better Haircut -

5Casey Neistat on

Productivity -

6Weatherproof

Your Sneakers -

7Save Money

Traveling -

8Work

Slower -

9Stay in

Shape -

10The "Good Day"

Drug -

11Get Bumped ...

for Good -

12Tim Ferriss on

Doing It All -

13Essential

Style Hacks -

14Get a

Raise -

15Get

Shit Done -

16A Successful

Morning -

17Change

Your Focus -

18Streamline

Your Grooming -

19Jeff Bezos on

Making Decisions -

20Fixing a

Bad Haircut -

21Learn a

New Hobby -

22Dress for

Success -

23Success at

Any Age -

24Sell

Yourself -

25Get Out of

a Meeting -

26Jay-Z on the

Keys to Success -

27Bad Breath

Hacks -

28Master Your

Credit Cards -

29Productivity

Myths -

30The First

5 Minutes -

31Be Better at

Flirting